What is Grab pay?

GrabPay is a payment method launched by Grab, which is a ridesharing service. This application is employed by more than 100 million users. It’s a location-specific option available in Singapore. It allows accessing various virtual payment methods from one GrabPay wallet. The methods that you simply can link to your wallet include bank cards, PayPal, etc. You’ll have this wallet installed on your mobile device, which suggests that you will not have to carry any cards or cash with you to make payments at online and land-based stores where this payment method is accepted.

You will be earning GrabRewards points. Once you collect a specific number of points, you’ll redeem them for vouchers. Also, it’s possible to convert them into KrisFlyer Miles. It doesn’t matter what type of transaction you make, you’ll be earning points anyway. To use this service, you want to be at least 16 years old, be a resident of Singapore or have valid permission to measure in the republic.

📈🤖 Unlock unparalleled trading potential with GPT Stocks Master AI! Revolutionize your portfolio, leveraging real-time insights and predictive analytics. Don’t miss out – step into a world where precision and profitability meet. Ready to transform your trading journey? Click “Master My Trades” now for your exclusive access! ✨🚀📊

Why use Grabpay?

Convenience: you’ll pay without any cash for a range of services. Simply download the app, link it with other payment methods, and you’re ready to use it;

Special rewards: you’ll be earning rewards for making transactions using the GrabPay payment method. This enables you to get vouchers and other rewards

Additional services: Initially, Grab was an app for riding needs, but today it is often used for a variety of purposes. As an example, you’ll use it to play for food delivery, subscription, and lots of other services

Top-Notch Security: There’s a large set of security measures available in the app, including PIN, biometric identification, 3-D secure protocols, and more. This suggests that you can use this payment option without worries.

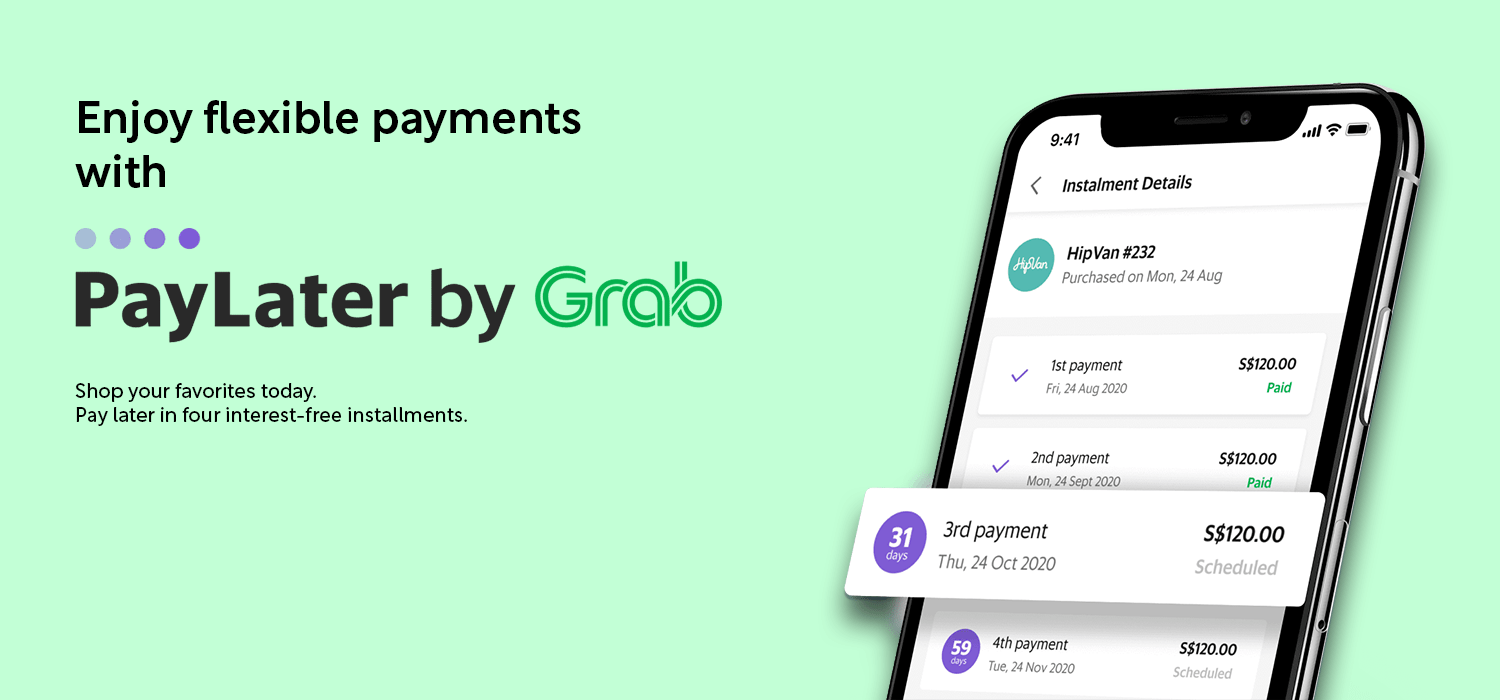

What is Grabpay later?

GrabPay later is another service provided by Grab to the purchasers where they can purchase the stuff they wish to and pay the amount later in small installments. this will be done up to a purchase of 1000 dollars a month.

Comparison and reviews:

Most of the purchasers gave a high review for the same as they were happy with having to pay only a fourth of the amount each month which gets deducted from your card on its own. They found no extra charges and were ready to manage their finances better.

Their late repayment fees are at rock bottom as you only need a pay a flat $10 admin fee to reactivate your suspended Pay Later account if payment is not made on time. The utility remains limited as you’ve got to top up your grab pay wallet to grab pay later.

Conclusion: GrabPay may be a pretty good payment option that allows making cashless payments for a large variety of services. The sole major drawback of GrabPay is that it can be used only by customers who live in Singapore. A crucial thing to keep in mind is that services like Grabpay can either be a good servant or a bad master and one needs to use it effectively.