About the Brand

Ex-Cap is a retail trading brand focused on providing access to crypto-denominated instruments. As the growth of the digital asset space continues, there is persistent demand coming from people who no longer want to use fiat when trading not just crypto, but any other asset class.

Our Ex-Cap broker review aims to focus on analyzing these tokenized assets and see what benefits traders get when signing up for an account. If you don’t know too much about this brand, bear with us as we discuss the main trading conditions.

CDI Coverage

Traders working with this company don’t lack optionality because there are hundreds of CDIs part of the mix. Alongside instruments based on popular coins (Bitcoin, Ether, Litecoin, Binance Coin, etc.), it’s possible to trade FX pairs, shares, indices and commodities as well.

Same as with any other regular brokerage, you can use up to 1:200 leverage, depending on what you want to trade. The account type doesn’t matter when it comes to margin requirements, but it will have an impact with regard to spreads.

Either way, all trades benefit from free account management and market execution. Ex-Cap promises to execute orders at the best market price, even when volatility picks up.

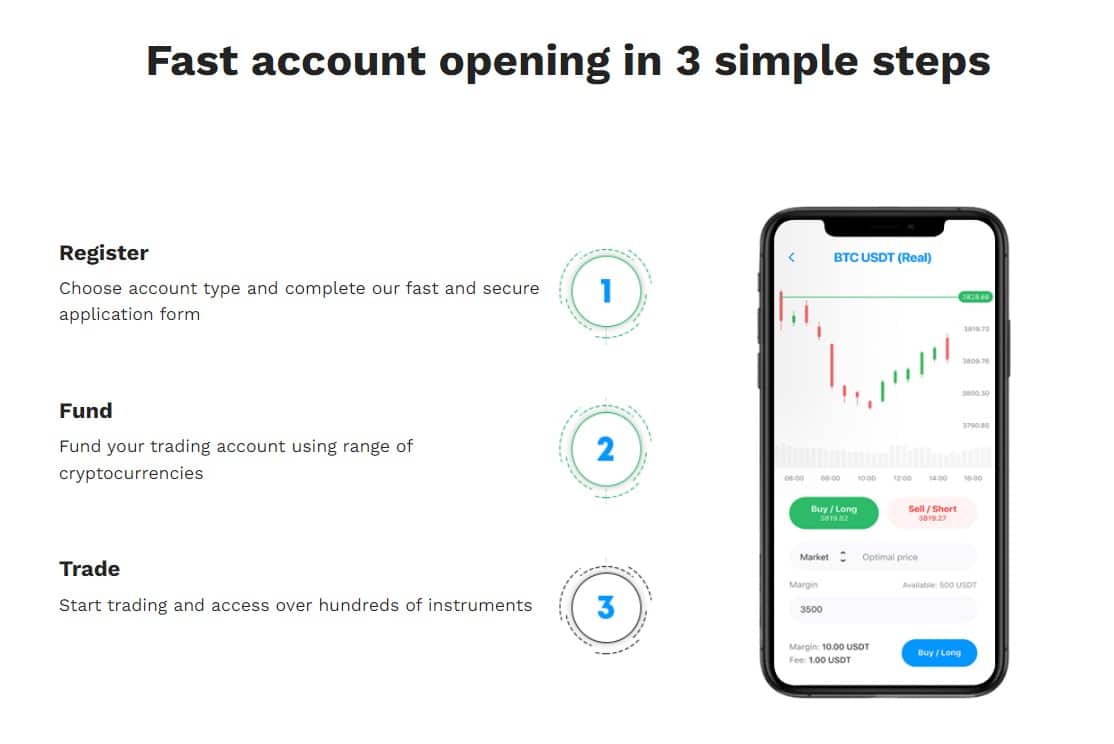

Registration

Speaking of registration, the process is pretty straightforward. You have to provide personal information and identification documents to pass KYC. The difference comes with deposits, given you can no longer use fiat and instead, you will have to fund your account with USDc.

The same goes for withdrawals. When you want to take funds out of your account, simply complete a request from your dashboard and the broker will process it to the wall address you provided. All the tokenized assets listed on the Ex-Cap platform are also priced in USDc.

Account Features

Because we discussed registration, it’s also important to note that there are three different account types available: Basic, Classic and Individual. With the Basic account, minimum spreads start from 1.5 pips, which is still a good figure. Keep in mind that spreads are variable and depend on what assets you want to trade as well.

Classic account holders benefit from spreads starting at 1 pips and that figure drops to as low as 0.5 pips with the Individual accounts. Differences emerge in terms of support as well. Basic accounts receive technical support and moving up to Individual, there is a dedicated account manager available at your disposal.

Another aspect we want to mention deals with commissions. Out of all three accounts, only Basic need to pay commissions on top of spreads. The other two no longer carry this additional cost.

Summary

As a whole, the CDI offer designed by Ex-Cap makes sense for crypto enthusiasts. It provides a comprehensive list of benefits, including broad asset coverage, three accounts, tailored support and competitive spreads.

Working with Ex-Cap seems suited also because the company operating the brand is registered with the FSA and is regulated as an international brokerage and clearing house company by M.I.S.A.